Bi-level Positive Airway Pressure (BiPAP) Devices Market Growth to USD$ 3.70 billion by 2033 | Emerging Players (2026)

BiPAP Devices Industry Forecast (2026-2033) | Global Adoption, Revenue Trends & Emerging Players

Bi-level Positive Airway Pressure Devices Market Insights | Advanced Sleep Therapy Growth Trends in United States and Japan”

AUSTIN, TX, UNITED STATES, February 19, 2026 /EINPresswire.com/ -- Market Size and Outlook (2026)— DataM Intelligence 4Market Research LLP

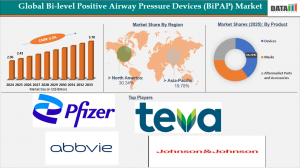

According to DataM Intelligence, the Global Bi-level Positive Airway Pressure (BiPAP) devices market was valued at USD 1.45 billion in 2024, is projected to rise to USD 2.43 billion in 2025, and is expected to reach USD 3.70 billion by 2033, growing at a CAGR of 5.5% between 2026 and 2033

The market expansion is being driven by rising prevalence of sleep apnea, chronic obstructive pulmonary disease (COPD), and other respiratory disorders, combined with increasing adoption of home healthcare solutions and remote patient monitoring systems. Technological advancements, such as smart BiPAP devices with integrated AI, wireless connectivity, and cloud-based monitoring, are improving patient compliance, therapy effectiveness, and clinician oversight.

Download Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):– https://www.datamintelligence.com/download-sample/bi-level-positive-airway-pressure-devices-market

FDA Approvals

• August 2025: PMA P240024 – FDA granted Premarket Approval for a respiratory support device (likely bilevel PAP variant) for adults ≥22 years failing CPAP or ineligible for it. Details limited to confirmed CPAP intolerance; intended for OSA therapy.

• 3B Medical Luna G3 Auto‑BiPAP (2021 clearance): FDA 510(k) for OSA with integrated heated tubing and cellular connectivity.

• Somnetics Transcend BiPAP (2020 EUA): Emergency Use Authorization for COVID‑19 respiratory support

New Device Launches by Companies

✅ Several updates and relaunches in 2025–2026 emphasize auto‑adjusting algorithms, connectivity, and CPAP alternatives:

✅ ResMed AirCurve 11 (Feb 2024 U.S. launch; 2025 international expansion): BiLevel device with ASVAuto algorithm (analyzes 13 breath indicators 50x/second) for personalized therapy. Compatible with all ResMed masks; integrates with AirView cloud and myAir app. Compliance improved to 87% with coaching.

✅ Luna G3 BiPAP (3B Medical; ongoing 2025 availability): Highlighted as top 2026 pick; auto‑adjusting with backup rate up to 25 cmH₂O, heated tubing.

✅ No major 2025–2026 launches reported beyond iterative updates (e.g., software for existing models). Market lists ResMed AirCurve BiPAP 10 VAuto and Luna G3 as leading options.

Growth Drivers

1. Over 936 million adults globally were diagnosed with sleep-disordered breathing in 2024, driving device adoption.

2. Remote patient monitoring integration is expected to improve adherence to BiPAP therapy by up to 40% by 2030.

3. Rising awareness of non-invasive ventilation (NIV) therapy among elderly and chronic respiratory patients.

4. Government healthcare initiatives in the U.S., EU, Japan, and India are increasing funding for home respiratory care solutions.

5. COVID-19 aftermath and post-acute respiratory syndrome are increasing BiPAP device usage in rehabilitation and homecare settings.

Regulatory Developments

✦ Ongoing Philips Recall (2021–2026): FDA continues oversight of ventilators, BiPAP, and CPAP due to foam breakdown risks; impacts millions of devices. Philips paused U.S. sales under 2024 consent decree.

✦ PMA P240024 (Aug 2025): Marks recent bilevel respiratory approval, signaling FDA openness to CPAP alternatives for severe OSA

Market Segmentation Analysis

By product segment, BiPAP devices dominated the global market, holding the largest revenue share of 55.71% in 2025.

By Technology / Modality

PROTACs: 42% share in 2024 (USD 1.26B), projected to reach USD 5.8B by 2032

Molecular Glues: 18% share in 2024 (USD 540M), expected to grow to USD 2.7B by 2032

Degronimids: 10% share in 2024 (USD 300M), projected at USD 1.2B by 2032

LYTACs: 6% share in 2024 (USD 180M), expected to reach USD 890M by 2032

AUTACs: 5% share in 2024 (USD 150M), projected at USD 730M by 2032

ATTECs: 4% share in 2024 (USD 120M), expected to grow to USD 610M by 2032

DUB Inhibitors: 5% share in 2024 (USD 150M), projected at USD 700M by 2032

SERD-based Degraders: 3% share in 2024 (USD 90M), expected to reach USD 410M by 2032

BET Degraders: 2% share in 2024 (USD 60M), projected at USD 280M by 2032

Others: 5% share in 2024 (USD 150M), expected to grow to USD 740M by 2032

By Target Protein Class

Transcription Factors: 28% share in 2024 (USD 840M), projected to reach USD 3.4B by 2032

Nuclear Hormone Receptors: 20% share in 2024 (USD 600M), expected to grow to USD 2.5B by 2032

Epigenetic Regulators: 15% share in 2024 (USD 450M), projected at USD 1.9B by 2032

Kinases: 12% share in 2024 (USD 360M), expected to reach USD 1.6B by 2032

Scaffold Proteins: 8% share in 2024 (USD 240M), projected at USD 1.1B by 2032

Misfolded/Aggregated Proteins: 10% share in 2024 (USD 300M), expected to grow to USD 1.3B by 2032

Others: 7% share in 2024 (USD 210M), projected at USD 920M by 2032

By Therapeutic Area

Oncology: 45% share in 2024 (USD 1.35B), projected to reach USD 6.2B by 2032

Immunology / Inflammatory: 15% share in 2024 (USD 450M), expected to grow to USD 2B by 2032

Neurology: 10% share in 2024 (USD 300M), projected at USD 1.3B by 2032

Ophthalmology: 5% share in 2024 (USD 150M), expected to reach USD 660M by 2032

Respiratory: 7% share in 2024 (USD 210M), projected at USD 900M by 2032

Infectious Diseases: 8% share in 2024 (USD 240M), expected to grow to USD 1.1B by 2032

Rare / Genetic Disorders: 5% share in 2024 (USD 150M), projected at USD 700M by 2032

Metabolic Disorders: 3% share in 2024 (USD 90M), expected to reach USD 420M by 2032

Others: 2% share in 2024 (USD 60M), projected at USD 280M by 2032

By Route of Administration

Oral: 50% share in 2024 (USD 1.5B), projected to reach USD 6.5B by 2032

IV (Intravenous): 25% share in 2024 (USD 750M), expected to grow to USD 3.2B by 2032

SC (Subcutaneous): 15% share in 2024 (USD 450M), projected at USD 2B by 2032

Intravitreal: 5% share in 2024 (USD 150M), expected to reach USD 700M by 2032

Others: 5% share in 2024 (USD 150M), projected at USD 690M by 2032

By Stage of Development

Discovery: 20% share in 2024 (USD 600M), projected to reach USD 2.5B by 2032

Preclinical: 15% share in 2024 (USD 450M), expected to grow to USD 1.9B by 2032

Clinical Trials (Phase I–III): 40% share in 2024 (USD 1.2B), projected at USD 5.3B by 2032

Approved / Commercialized: 25% share in 2024 (USD 750M), expected to reach USD 3.2B by 2032

By End User

Hospitals: 35% share in 2024 (USD 1.05B), projected to reach USD 4.6B by 2032

Clinics: 20% share in 2024 (USD 600M), expected to grow to USD 2.5B by 2032

Research / Academic Labs: 15% share in 2024 (USD 450M), projected at USD 1.9B by 2032

Pharma / Biotech: 20% share in 2024 (USD 600M), expected to reach USD 2.7B by 2032

CROs: 10% share in 2024 (USD 300M), projected at USD 1.3B by 2032

By Age Group

Children & Adolescents: 10% share in 2024 (USD 300M), projected to reach USD 1.3B by 2032

Adults: 65% share in 2024 (USD 1.95B), expected to grow to USD 8B by 2032

Geriatric: 25% share in 2024 (USD 750M), projected at USD 3.2B by 2032

By Degradation Pathway

Ubiquitin–Proteasome System (UPS): 45% share in 2024 (USD 1.35B), projected to reach USD 6B by 2032

Autophagy–Lysosome: 25% share in 2024 (USD 750M), expected to grow to USD 3.2B by 2032

Endosome–Lysosome: 10% share in 2024 (USD 300M), projected at USD 1.3B by 2032

Chaperone-Mediated: 5% share in 2024 (USD 150M), expected to reach USD 660M by 2032

Others: 15% share in 2024 (USD 450M), projected at USD 2B by 2032

By Protein Localization

Nuclear: 30% share in 2024 (USD 900M), projected to reach USD 4B by 2032

Cytoplasmic: 25% share in 2024 (USD 750M), expected to grow to USD 3.2B by 2032

Membrane-Bound: 20% share in 2024 (USD 600M), projected at USD 2.7B by 2032

Extracellular: 15% share in 2024 (USD 450M), expected to reach USD 2B by 2032

Others: 10% share in 2024 (USD 300M), projected at USD 1.3B by 2032

Request for Customized Sample Report as per Your Business Requirement:- https://www.datamintelligence.com/customize/bi-level-positive-airway-pressure-devices-market

By Region

North America

North America dominates the global Bi-level Positive Airway Pressure (BiPAP) devices market, accounting for the largest revenue share of 30.34% in 2025.

High adoption in the U.S. due to rising sleep apnea prevalence and reimbursement coverage for home NIV therapy.

Europe

Market size: USD 412M (2024) → USD 1.48B (2032)

Germany, UK, and France lead adoption; aging population and robust homecare policies drive demand.

Asia-Pacific

Market size: USD 283M (2024) → USD 940M (2032)

Japan, China, and India show fastest CAGR; rising awareness, increasing chronic respiratory disorders, and growing healthcare infrastructure.

Rest of the World (RoW)

Market size: USD 143M (2024) → USD 480M (2032)

Middle East and Latin America witnessing gradual adoption in private hospitals and homecare setups.

Competitive Landscape

The BiPAP devices market is moderately consolidated with major medical device companies and emerging healthcare startups driving innovation in smart therapy, patient comfort, and telehealth integration.

Key Players

1. Philips Respironics

2. ResMed Inc.

3. Fisher & Paykel Healthcare

4. DeVilbiss Healthcare

5. Drive DeVilbiss Healthcare

6. BMC Medical

7. Invacare Corporation

8. Somnetics International

Key Highlights:

✅ Philips Respironics launched AI-driven BiPAP devices with cloud-based adherence tracking (Jan 2025).

✅ ResMed’s AirSense 11 ST model reported 18% YoY adoption growth across homecare settings (Feb 2025).

✅ Fisher & Paykel introduced compact portable BiPAP with auto-adjusting pressure for travel patients (Mar 2025).

✅ BMC Medical expanded distribution in Asia-Pacific, reaching 120,000 units in 2024.

Recent Developments

🔹 Philips Respironics partnered with telehealth providers to integrate BiPAP devices into remote monitoring platforms (April 2025).

🔹 ResMed acquired an AI start-up for predictive respiratory therapy adherence analytics (Feb 2025).

🔹 Drive DeVilbiss Healthcare launched eco-friendly, low-noise BiPAP devices for homecare (Jan 2025).

Buy Now & Unlock 360° Market Intelligence:- https://www.datamintelligence.com/buy-now-page?report=bi-level-positive-airway-pressure-devices-market

Market Outlook & Opportunities

1. Homecare BiPAP segment projected to exceed USD 2.5B by 2032, driven by telemedicine and patient-centric therapy.

2. Asia-Pacific expected to record fastest CAGR (15%), driven by rising awareness, growing healthcare budgets, and chronic respiratory disorders.

3. Integration with IoT, AI, and cloud platforms can unlock USD 600M additional value by 2032.

4. Smart BiPAP devices with automated pressure adjustment and real-time adherence monitoring expected to become standard in chronic respiratory care by 2030.

Conclusion

The Global Bi-level Positive Airway Pressure Devices Market is witnessing a transformation from conventional respiratory therap, BiPAP devices are becoming essential in managing sleep apnea, COPD, and chronic respiratory diseases.

With technological innovation, telehealth integration, and regulatory support, BiPAP devices are redefining non-invasive ventilation, improving patient adherence, and reducing hospitalization rates globally.

Related Reports

Positive Airway Pressure (PAP) Devices Market

Continuous Positive Airway Pressure (CPAP) Devices Market

Sai Kiran

DataM Intelligence 4market Research LLP

+1 877-441-4866

sai.k@datamintelligence.com

Visit us on social media:

LinkedIn

YouTube

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.